Artificial Intelligence in Stock Market Trading

Artificial Intelligence Stock Trading : There are many ups and downs in business through the stock market and trading, and at this time it is not wrong to say that Artificial Intelligence has not entered the world of trading. Nowadays, everyone is using Artificial Intelligence, such as taking help in content writing, image and video creation, presentation, voice over etc. and it must have also been seen that AI is also being used in many stock market or trading applications.

AI in trading can be able to make market analysis decisions, avoid business risks and give us information about many possibilities in the future. Many types of questions must be arising in the minds of all of you that, what is the importance of AI in trading? What impact can the arrival of AI have on trading and business? Can you also easily trade through AI? We will try to give you information on many such questions and will also tell you to what extent AI is working in business at present and what impact it can have on us in the future.

Introduction to AI in Trading:

By getting information about the data and trends used in the stock market, AI can help in finding out about the future predictions. Through Artificial Intelligence, investors can buy and sell shares of the stock market according to their investment method and can get help in accelerating the business.

By using the patterns and activities happening in the stock market correctly, one can make the right strategies and make his portfolio beautiful by automating the stock. The use of AI in the stock market can help humans in getting profit and accuracy in business.

How AI Works in Trading & Stock Market :

Artificial Intelligence works in the stock market through many techniques like Machine learning algorithms, Natural Language Processing (NLP) and Data analytics. The use of high-frequency trading, algorithmic trading and quantitative trading techniques can help in providing information about the changes in the market, so that trades can be executed easily with the help of AI trading.

- Data Analysis: Through AI, many types of data of the stock market can be collected and modified to make predictions.

- Old stock price – By collecting old data of the stock market, its future forecast can be estimated. And their future prices can be estimated.

- Data can be analyzed through market trends, news articles and social media and by comparing it with the financial statements of your company, its shortcomings can be found and improved.

- Predictive and Sentiment Analysis: Stocks can be analyzed through AI.

- Financial market news and articles can be analyzed through AI NLP tools to set their indicators.

- By analyzing the data during special events, price movements can be tracked and predicted. While tracking, stocks can be bought during good indicators and stocks can be sold during negative indicators.

- Algorithmic Trading and Machine Learning Models: Identifying trade patterns according to stock market data, real-time analysis and trading can be automated based on predefined parameters in the system.

- Such models or such AI patterns should be developed which should train themselves with time in the future, so that it can predict the prices of stocks correctly.

- AI can understand the trade in a short time and can buy and sell it at the correct valuation. Which is much faster than the efficiency of humans. – With the help of AI, it can handle multiple trades simultaneously and by checking their accuracy, it can help in further improving the market execution.

Applications of AI in Trading :

⇒ Advance Trading: With the advent of Artificial Intelligence, trade can be trained to make more profits in less time. So that people can use their trade in a better and accurate way.

⇒ AI based Tools: More and more tools can be developed for stock market or trading. So that simple methods can be used to trade. And it can help in getting out of the risks that come in time.

⇒ Portfolio Management: A good trader wants to manage his trend portfolios well. For this, AI can help you. So that you can make your portfolio beautiful and simple.

⇒ High-frequency trading: Through AI, the trader can manage different ways of trading in his portfolio at the same time.

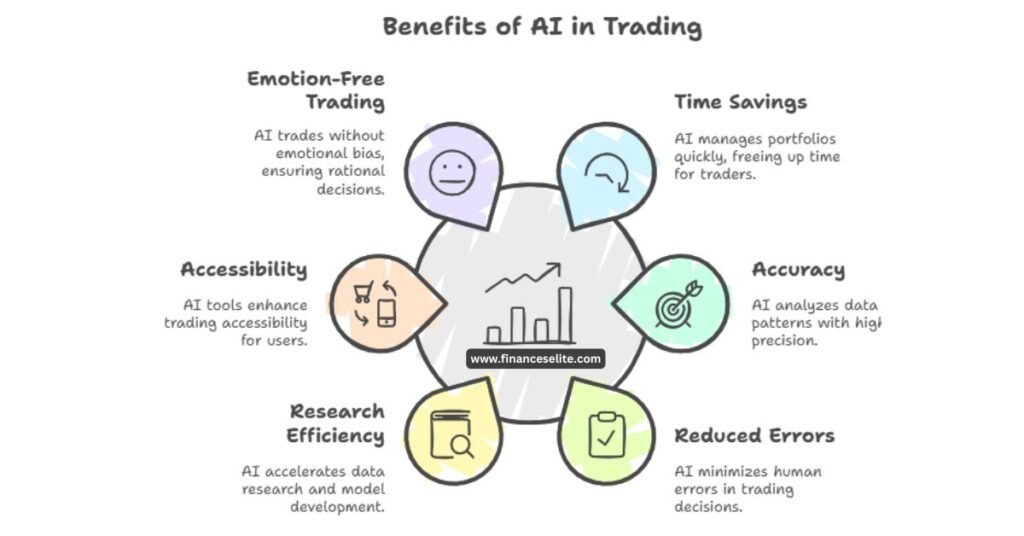

Benefits of AI in Trading

It has been seen now that AI is being used in trading and stock market in some countries, in which it has been seen that with its use, trade data can be easily managed and with the advent of AI, many human tasks are being done easily. AI follows its given rules and strategies.

⇒ Save Time: AI can easily manage your portfolios, AI can provide you information about good trades by analyzing data through its algorithm models. Due to which your maximum time is saved.

⇒ Accuracy : Through AI, by collecting information of many trades and analyzing it, it can give you information about the patterns of trades with accuracy.

⇒ Reduction of human error : Humans can change their ways of working, so that many types of work can be done at the same time through AI. It can easily analyze the data of any large trading, which takes time for humans to do and it is not even possible that its result will be complete with accuracy.

⇒ Reducing Research Time : With the advent of AI, humans take less time to research data and new models of AI can be designed with it. This can save your time and can help in making your portfolio beautiful.

⇒ Accessibility : Many types of tools can be made for trading, using AI, buying and selling can be done automatically for trading. New patterns can be invented for trading. Which can be easily used by users.

⇒ Emotion Free Trading : There are fluctuations in the market, human characters get nervous during the fall of the market and often get excited in a fast rising market. Due to which a human takes his good and bad decisions quickly, but AI trades based on data or completely determined strategies, due to which you can get many types of benefits due to fewer errors.

Challenges and Limitations of AI in Trading:

This growing AI technology is being used in many ways in trading, due to which a person can easily trade and make his trade portfolio beautiful and make good profits. But its arrival can cause harm to small investors and other investors. Using it in trading can also benefit everyone, and its arrival can bring challenges and risks in the future:

⇒ Quality Data: If you want to make a proper and correct estimate of the trade, then it is necessary to provide the correct data of trading to AI. With the help of which future estimates can be made correctly. If wrong or incomplete data is given in any way, then AI can make its estimate wrong.

⇒ Market Changes: It has been seen many times that sudden changes can be seen in the stock market during economic crisis or natural disaster. If AI is not prepared for all these things, then traders and business may have to take more risks.

⇒ Complex System: AI is used in trading on the basis of many types of algorithms and patterns, which require the help of many experts to create them. If AI is made to take decisions on its own, then if something goes wrong, it can be difficult to detect and it can also take more time to correct it.

⇒ Cost: It costs more to create and maintain an AI system in trading, which can be created by big investors. Due to this, it may be difficult for small investors to compete in the stock market.

Future of AI in Trading:

With time, artificial intelligence has started being used, its use is also being seen in the world of trading. In the coming time, trading in AI can be predicted by analyzing more data in depth. Trading can be easily automated through this.

While big traders are earning more profits by using advance technology for trading, similarly, small traders and traders are also emerging from their risks through AI portfolio management and AI trade bots through Tools Subscription through some companies.

Using AI based data analysis and machine learning, future losses can be easily predicted and it is also possible to sense sudden changes in the market. AI is making trading smarter and more personalized, so that investors can invest with their new strategies.

However, there are some challenges with the arrival of AI, such as data quality, error data and cyber security. etc. But these challenges can be solved through experts. And in the future, trading with AI will become so simple that anyone can operate it easily and there will be no need to be technical or expert for it.

AI Trading vs. Traditional Trading: Pros and Cons Compared

At present, AI trading is becoming increasingly popular because it is able to collect, analyze and make decisions quickly by collecting large amounts of data. There are advantages and disadvantages of using AI in traditional trading and trading. In traditional training, a person trades through his understanding and experience. It is able to handle unexpected situations in sudden market fluctuations in a better way.

Through traditional training, a personal connection is formed with the investor and one is also able to make in-depth strategies. But emotions can affect a person, due to which he can make mistakes. According to this changing market, the trading ability of a person to work can slow down.

Through AI, even the largest data can be analyzed easily. Whereas AI is completely dependent on data in trading. If it is given wrong data or less data, then in the future, forecasting may lead to heavy losses in business. But this technology is capable of working 24/7 as compared to humans, so that we can take advantage of every opportunity in the market. AI trading and traditional trading can be evaluated according to different parameters.

| Parameters | AI Trading | Traditional Trading |

| Speed | Very fast and automated as compared to traditional trading | AI trading is slower than human-based trading. |

| Data Analysis | Even the largest amounts of data can be analyzed instantly. | Limited data analysis, human-dependent |

| Emotional impact | Is able to take decisions without emotions. | Human beings can be affected by fear, greed and other emotions. |

| Cost | Expensive (in technology and setup) | It is comparatively less expensive because humans work in it. |

| Flexibility | It just depends on the data and programming(algorithm). | Based on human understanding and Experience |

| 24/7 Trading | 24/7 trading is possible | It depends on the strength of the human being. |

Frequently Asked Questions :

Conclusion:

Artificial Intelligence is revolutionizing the world of trading. It is helping in making fast and accurate decisions by collecting old and current data of the stock market and analyzing it through its algorithm. Artificial Intelligence is considered to be the biggest technology at present, this technology is capable of working 24/7 day and night.

However, there are some risks associated with this technology, such as due to incorrect data or technical fault, the upcoming estimate cannot be evaluated properly. Due to which one may have to take risk in business. This technology cannot make 100% proper evaluation in trading because it cannot understand the sudden change in the market properly. Before using Artificial Intelligence in trading, you should pay attention to what rules are applicable in your country related to AI trading, and in most countries AI Trading can also be illegal. Investors should know this before starting AI trading.

Everyone should keep in mind that Artificial Intelligence can be used as a tool to assist humans. Humans should not rely on Artificial Intelligence. If humans use Artificial Intelligence with their intelligence and understanding, then it can be useful for everyone in public interest.