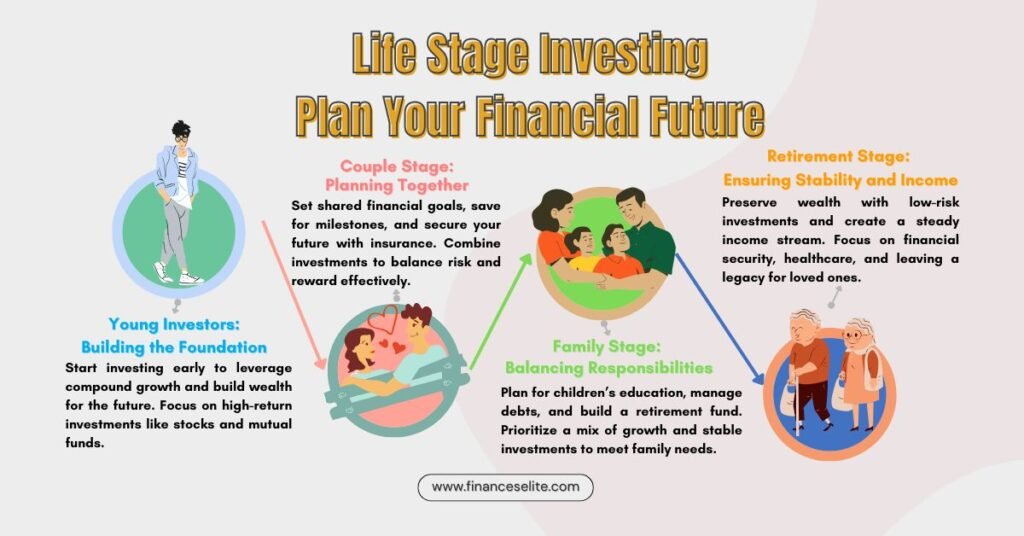

Life Stage Investing: Plan Your Financial Future

Financial Milestones :Personal finance may seem complex at first glance, but if adopted with the right strategy, it can lead to a secure and prosperous future. Investing at different stages of life aligns your investment options with your financial goals and requirements. This ensures that your financial decisions keep pace with your changing life.

Whether you are starting your career, in mid-life or approaching retirement, this article will help you make the right investment decisions. Its main objective is to maximize your risk tolerance, retirement planning and achieve financial stability. By adopting the right investment approach, you can achieve your financial goals effectively and successfully.

Understanding Life Stages and the Role of Investment

Everyone faces different challenges and opportunities at various life stages. It is very important to recognize all these and prepare an investment plan accordingly. This process not only secures your financial goals but also gives you the flexibility to adjust your investment strategy when needed.

This article provides you with clear information on the important factors affecting your financial future. The strategies and tools discussed here will help you navigate your financial choices with confidence.

What is life stage investing?

Life stage investing is about planning your money according to your current life. It involves adjusting your investments and asset allocation based on your age, income and responsibilities. The main goal is to maximize returns while minimizing risk at each life stage. Whether you want to build wealth when you are young or create an income stream in retirement, these strategies are helpful in every situation.

Why is life stage investing important?

As you age, your needs and priorities change. It is important to adapt your financial plan to each stage of your life. For example, you may be more risk-averse when you are young, but as you approach retirement, you need stable and safe investments.

Life stage investing helps you keep your portfolio in sync with your changing life needs and risk tolerance. This helps you achieve your long-term financial goals easily and also secure your future.

Whether you are a fresher starting your career or a retired person, life stage investing is a wise strategy for everyone. It helps you achieve your financial goals, no matter what stage of life you are at.

Life Stage Investing, Retirement Planning, Wealth Accumulation and Risk Tolerance

When it comes to managing your money wisely, it is important to focus on life stage investing, retirement planning and wealth accumulation. This requires a good understanding of your risk tolerance and financial goals. This understanding helps you create an investment strategy that is right for your needs and circumstances.

Investing keeping all these aspects in mind is the mantra of success in the long term. With the right planning and discipline, you can not only meet your financial goals but also create a secure future for yourself and your family.

| Factor | Importance in Life Stage Investing |

| Retirement Planning | Ensures you have the necessary resources to maintain your desired lifestyle in retirement. |

| Wealth Accumulation | Helps you build financial security and achieve your long-term financial goals. |

| Risk Tolerance | Determines your asset allocation and portfolio diversification strategies, which can impact your investment returns and risk exposure. |

| Financial Goals | Provides a clear roadmap for your investment decisions and helps you measure your progress over time. |

Understanding the interplay between these factors is important. This allows you to develop a comprehensive investment strategy for different stages of life. This strategy balances retirement planning, wealth accumulation, and risk tolerance. It facilitates informed decisions and actions that support your long-term financial goals.

Investment strategies for different life stages:

Young investors: A strong start is a must:

If you are young and want to secure your future financially, it is important to build a strong investment base right from the start. This means investing your money in the right place, diversifying your portfolio and setting savings goals that are easily achievable. These steps will benefit you in the long run and help you fulfill your big dreams for the future.

Remember, the biggest advantage of starting investing at a young age is “long term”. Over time, the magic of compounding can multiply your money manifold. So don’t delay, start investing now and gradually make your dreams come true.

| Investment Strategy | Key Considerations |

| Asset Allocation | Balancing growth-oriented and conservative investments |

| Portfolio Diversification | Spreading investments across different asset classes |

| Savings Goals | Identifying short-term, mid-term, and long-term financial objectives |

| Emergency Fund | Building a cash reserve for unexpected expenses |

| College Savings Plans | Investing in dedicated college savings accounts |

By adopting these strategies, young investors can establish a solid financial foundation. This approach helps them deal with market fluctuations, setting the stage for long-term financial growth and security.

Midlife investment strategies: Proceed wisely

When you are in the middle phase of your career, it is time to change your investment strategy. At this age, your expenses and responsibilities have increased, so you need to adapt your strategy according to your financial needs and goals. Adopting the right investment strategy at this stage not only keeps your money safe, but also lays a strong foundation for future retirement.

- Maintain a Balanced Asset Allocation: The most important thing in midlife is to maintain a right balance in your investments. This means investing some money in growth investments (such as the stock market) and the rest in investments that provide steady and safe income (such as bonds or fixed deposits). This balance gives your money a chance to grow, while also providing you stability.

- Manage Risk Properly : At this age, you should be a little cautious in taking risks. Avoid market fluctuations or investing too much in one place. Diversify your portfolio to reduce the chances of loss. Also, focus on tax-efficient investments so that your earnings are used properly and your wealth is protected.

Re-Evaluate Financial Goals :

- At midlife, re-evaluate your small and big goals.

- Creating a fund for children’s education.

- The dream of buying a vacation home.

- Building a good fund for retirement.

These goals of yours are now clearer than before, so it is important to adjust your investments according to these goals. This will keep you moving in the right direction.

Focus on Wealth Preservation and Income Generation :

At this age, your first priority should be to keep your money safe. Also, focus on investments that give regular income, such as rental properties or dividend-yielding stocks.

In short:

- Maintain a balance of assets.

- Control risk with diversification and tax-efficient investments.

- Review financial goals from time to time.

- Priorities money safety and regular income.

By adopting a strategic and flexible approach to midlife investing, you can cross this crucial stage without any worries. Taking the right steps will not only keep your money safe but also lay a strong foundation for the future.

Retirement Planning and Income Generation: Understand in Simple Language

As retirement approaches, your financial needs start changing. At this time, you should adjust your savings and investments in such a way that not only your money is safe, but you also get regular income. The most important thing in this phase is to reduce risk and keep the income stable.

How to prepare a portfolio for retirement?

At the time of retirement, it is important to strike the right balance between growth (increasing money) and stability (keeping money safe). For this, you should do the following things:

- Invest in bonds and annuities: These investments will give you a stable and assured income. Bonds and annuities help protect you from market fluctuations.

- Diversify: Do not depend only on traditional investments. Include alternative investments like real estate, gold or other precious metals in your portfolio. These keep your assets safe as well as flexible.

How to increase retirement income?

Increasing or maintaining stable income after retirement is not possible without a plan. For this, some important steps have to be taken:

- Make proper use of social security: If you can avail the benefits of any government scheme or pension, then use it at the right time. This will ensure your regular income.

- Choose tax-beneficial investments: Invest in retirement accounts that give you tax relief. This will not put much burden on your savings.

- Rental property and dividend shares: If you have a property to rent out, then it can generate a good income. Apart from this, you can also earn regular income by investing in dividend-paying shares.

- Review regularly: Check your retirement plan from time to time. Keep updating it as per the need so that you can handle any changes in the future.

With smart planning during retirement, you can not only keep your money safe but also ensure a steady income. Minimize risk, choose the right investments, and review your plan regularly. This will make your retirement years comfortable and secure, without any worries.

Conclusion: The Role of Savings in Financial Security

Savings build a strong financial base at every stage of life and provide protection against future uncertainties. It is the first step towards financial independence, which not only helps us meet our small and big goals but also prepares us for emergencies. Savings and right investments in youth provide an opportunity to accumulate wealth for your future. Savings in midlife helps you to meet family responsibilities, such as children’s education, buying a house or other necessary expenses. At the same time, it becomes a source of stable income at the time of retirement, making life comfortable and worry-free.

Therefore, it is very important to inculcate the habit of saving at the right time and make smart investments so that financial strength and self-reliance is maintained at every turn of life.