SIP Planner Online Calculator

SIP Calculator

Future Value: $0.00

Total Investment: $0.00

Wealth Gained: $0.00

Annual Calculation

| Year | Investment Value | Wealth Gained |

|---|

Mutual Funds have become the go-to option for many people to boost their financial growth. There are two ways to invest in Mutual Funds namely Systematic Investment Plan (SIP) and Lumpsum. While SIP is for monthly investment, Lumpsum is for one-time investment.

To help all you investors in Compound Interest Sip investing, we have designed SIP and Lumpsum calculators to calculate returns. Here we will explain how these calculators work, formulas and examples to make it clear how they work.

What is a SIP Online Investment Calculator?

SIP calculator is a tool that helps you calculate the future value of your periodic investment in Mutual Funds. Enter monthly investment, expected return and period to get the estimated value at the end of the period.

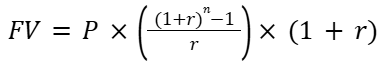

Formula for SIP SIP Return Calculation :

SIP calculation uses the following formula to estimate the future value of a series of investments and using this we have created this SIP Calculator one Time for you:

Where:

- FV = Future Value of the SIP

- P = Monthly investment amount

- r = Monthly rate of return (annual rate divided by 12 and converted to decimal)

- n = Total number of months

Example of SIP Calculation :

Let’s assume:

- Monthly Investment (P): $500

- Annual Return Rate: 12% (Monthly rate, r = 12%/12 = 1% or 0.01)

- Tenure: 5 years (n = 5 x 12 = 60 months)

Using the formula:

.img

This calculation is based on the estimated amount you will get after 5 years of the amount you have invested. So that you can invest your money in a good company.

What is a lumpsum calculator?

Apart from investing in mutual funds through SIP, you can also invest in lumpsum. Through the lumpsum Investment calculator, the investor can easily estimate the amount of his lumpsum. Unlike SIP, where you invest in SIP over a period of time, lumpsum investment involves a one-time initial investment. The calculator helps in predicting the maturity value based on the lump sum amount, duration and expected return rate. This information may change with time and company.

Formula for lumpsum calculation:

The lumpsum formula follows the compound interest model, which is:

.img Formula

Where:

– FV = Future Value of the investment

– P = Initial investment amount

– r = Annual rate of return (converted to decimal)

– n = Investment duration in years

Example of Lumpsum Calculation

Let’s assume:

– Initial Investment (P): $ 10,000

– Annual Return Rate: 10%

– Tenure: 5 years

Using the formula:

FV=10,000(1+0.10)5

By calculating, we’ll obtain the approximate future value of this one-time investment after five years.

How Investors Can Benefit Using SIP and Lumpsum Calculator

Investors use several calculators to plan their investments, which can calculate both cost and returns. By using SIP Reverse Calculator and Lumpsum calculators, investors can maximize the benefits of their investments. Here is how these calculators will benefit you:

1. Financial Goal Planning:

2. Simplified calculations:

3. Making informed decisions:

4. Flexibility in customization:

5. Maximize Returns:

6. Better Budget Management:

Sip Calculator For Months Insights: Investors can create monthly budgets based on the actual amount needed for their SIPs.

– 7. Promotes financial literacy by simplifying investment concepts such as compound interest and rate of return.

– Raises Awareness: Informs investors about the effects of time and rate of return on their portfolio.

8. Saves time: –

Using these calculators allows investors to make better, more informed decisions, paving the way for financial growth and stability.